In today’s digital era, the financial services industry is experiencing a massive influx of data on a daily basis. This data, if properly managed and integrated, holds immense potential for financial institutions to gain deeper insights into their existing clients, identify new business opportunities, target specific audiences, and analyze the competitive landscape. Data integration services play a crucial role in unlocking these valuable business insights and driving strategic decision-making in the financial services industry.

Challenges in the Financial Services Industry

The abundance of data also poses significant challenges for financial institutions. One major hurdle is that much of their data is stored and managed in legacy systems, which often lack the flexibility and agility required for seamless integration with modern technologies. The financial services industry is highly regulated, requiring strict adherence to legal and regulatory compliance, as well as robust data security and fraud detection measures. These challenges have prompted banks and financial institutions to implement complex and costly frameworks to ensure data availability and compliance.

Benefits of Streamlined Data Integration

Streamlined data integration brings numerous benefits to the financial services industry, addressing the challenges mentioned above and enabling financial institutions to thrive in a rapidly evolving digital landscape.

Let’s explore the key advantages of data integration in the financial services industry:

Fraud Detection and Compliance

In the financial services industry, real-time data integration is crucial for fraud detection and compliance. By integrating and streaming data in real-time, financial institutions can identify anomalies and potential risks as soon as they arise. Real-time visibility, coupled with AI and machine learning algorithms, empowers fraud detection teams to proactively identify and mitigate threats before they escalate. However, many financial institutions struggle to leverage real-time data due to the lack of connectivity between legacy systems and newer technologies. Data integration bridges this gap, enabling seamless data flow and empowering financial institutions to combat fraud effectively.

Insights about Customers

Delivering exceptional customer experiences has always been a top priority for financial institutions. Data integration has revolutionized customer insights, allowing financial institutions to gain a comprehensive understanding of their customers beyond regulatory requirements. With advancements in cloud storage and processing power, leading companies are leveraging data integration services to gain valuable insights that drive competitive advantage. Integrating data across transactional systems, customer relationship management platforms, and digital marketing automation tools enables financial institutions to achieve a 360-degree view of their customers. This holistic view helps identify customer needs, prevent customer attrition, and engage customers in personalized and meaningful ways.

Improved Business Efficiency

Technological advancements, such as cloud computing and mobile devices, have triggered significant innovation in the financial services industry. Financial institutions have embraced online technology and mobile banking services to provide customers with convenient and efficient banking experiences. However, the integration of these services has often been time-consuming and expensive, relying on specialized projects that require significant resources. Streamlining and automating integration processes through data integration solutions can enhance business efficiency, reduce costs, and facilitate the rapid deployment of new innovative services. By optimizing integration capabilities, financial institutions can adapt to evolving customer needs and market demands more effectively.

Enhanced Risk Management

Risk management is a critical aspect of the financial services industry. Data integration plays a vital role in improving risk management processes by ensuring accurate and up-to-date data across various systems and applications. By integrating data from multiple reliable sources, financial institutions can gain a comprehensive understanding of potential risks, improve risk assessment models, and enhance risk mitigation strategies. Data integration also enables better regulatory compliance by providing a unified view of data, simplifying auditing processes, and ensuring adherence to legal and regulatory requirements.

Greater Business Agility

In the highly competitive financial services industry, business agility is essential for staying ahead of the curve. Data integration enables financial institutions to quickly adapt to market changes, launch new products and services, and respond to customer demands with agility. By integrating data from various sources, financial institutions can make informed decisions based on real-time insights, identify emerging trends, and capitalize on new business opportunities. This agility gives financial institutions a competitive edge in a rapidly evolving market.

Improved Data Governance and Quality

Data governance and quality are critical factors for the success of financial institutions. Data integration solutions enable centralized data management, ensuring consistent data governance practices and high data quality standards. By integrating data from diverse sources, financial institutions can establish a single source of truth, eliminate data silos, and ensure data consistency and accuracy. Effective data governance and quality control enhance regulatory compliance, increase operational efficiency, and facilitate data-driven decision-making.

Conclusion

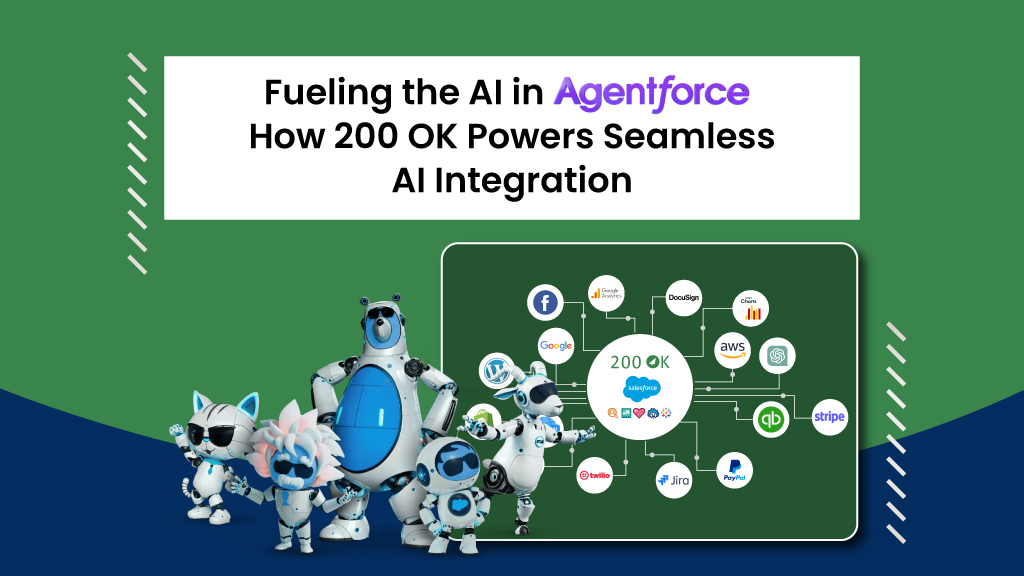

Data integration is a game-changer for the financial services industry, offering immense opportunities to gain deeper insights, improve business efficiency, enhance risk management, and achieve greater agility. Streamlining this process empowers exceptional customer experiences and innovation. To thrive, financial business owners must embrace these solutions, like our 200 OK integration platform. 200 OK, our no-code integration platform is reshaping the financial industry’s integration journey, unlocking data’s potential, and ensuring competitiveness, compliance, and customer-centricity in the digital age.